Mathematical Models for Funding Saturation

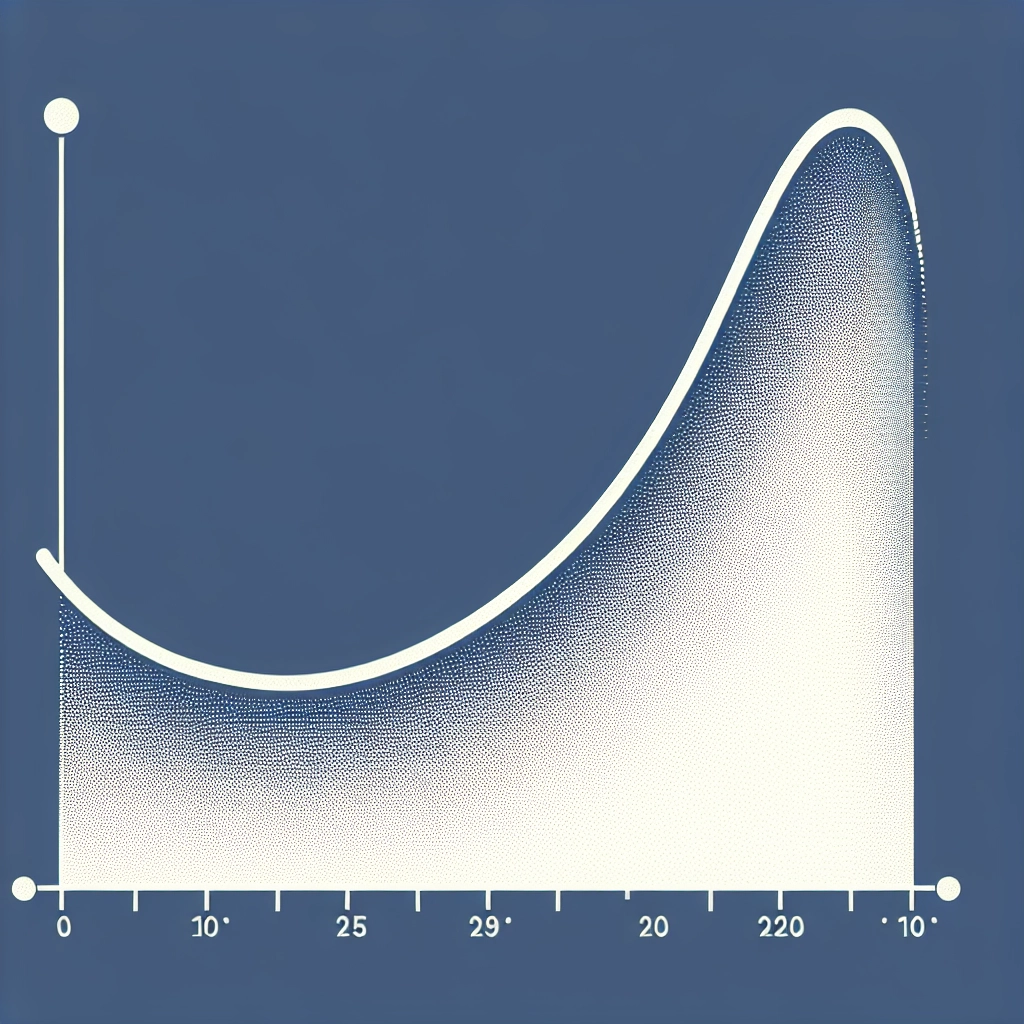

The S-curve model stands out as a powerful tool for measuring philanthropic impact and predicting funding saturation points. This mathematical framework maps the relationship between resources invested and social outcomes achieved. The model shows rapid initial gains that level off as programs mature, similar to how technology adoption curves behave. Donors and financial advisors can use this data to identify the sweet spot where additional funding produces optimal returns.

Regression analysis adds another layer of precision to charitable giving optimization. By tracking multiple variables like program costs, beneficiary reach, and outcome metrics over time, we can spot emerging patterns. These patterns reveal when programs start hitting diminishing returns. The data often shows that doubling funding rarely doubles impact once programs reach maturity.

Five large foundations (Ford Foundation, Hewlett Foundation, MacArthur Foundation, Open Society and the Packard Foundation) found that the charities they support, even well-known organizations, weren't getting enough money to cover the cost of their operations and are taking corrective action to increase the amount of their funding that nonprofits may spend on overhead.

Real-world examples demonstrate these mathematical principles in action. A food bank might show strong initial impact scaling as it builds infrastructure and reaches more communities. However, data typically reveals diminishing returns once basic local needs are met. The same patterns emerge in education programs, where initial investments in curriculum and teacher training yield high returns before plateauing.

Read: Network Effect Measurement: How Charitable Impact Creates Ripple EffectsModern statistical tools have enhanced our ability to predict these saturation points with greater accuracy. Machine learning algorithms can process vast datasets from multiple charitable programs to identify common patterns. These tools help wealth managers and donors make more informed decisions about resource allocation across different causes and organizations.

- Key indicators of approaching saturation include:

- Declining percentage improvements in outcome metrics

- Rising cost per beneficiary served

- Increasing operational complexity without proportional impact gains

- Reduced marginal utility of additional funding

Identifying the Inflection Point

Charitable programs often follow predictable patterns of impact that mirror economic principles of diminishing returns. Smart donors track specific metrics to spot early warning signs that additional funding might yield lower social returns. These indicators include cost-per-beneficiary ratios, program completion rates, and operational efficiency measurements. Data-driven philanthropy requires regular assessment of these metrics against established benchmarks.

Modern statistical tools make it easier than ever to measure the marginal utility of each additional dollar donated. Organizations can plot impact curves using regression analysis and time-series data to visualize where returns begin to flatten. Key performance indicators like beneficiary satisfaction scores, program scalability metrics, and resource utilization rates provide crucial insights into program effectiveness.

The Fundraising Effectiveness Project (FEP) Report in 2023 revealed that while donor retention rates for nonprofits initially improved at the beginning of the year, they began to decline again around July.

A recent education initiative in Chicago demonstrates these principles in action. The program tracked student achievement scores against funding levels across 50 schools. After reaching $2,500 per student in additional support, test score improvements plateaued significantly. This clear inflection point helped administrators optimize resource allocation and redirect excess funds to other high-impact areas.

- Monthly beneficiary outcome tracking

- Cost-per-impact ratio analysis

- Program capacity utilization rates

- Staff-to-beneficiary ratios

- Quality of service measurements

Financial advisors can help donors identify these inflection points through quantitative analysis tools. Simple spreadsheet models can track key metrics over time and generate alerts when marginal returns begin to decrease. This data-driven approach helps ensure charitable dollars create maximum social impact through optimal resource allocation.

Read: Maximize Small-Scale Philanthropy ROI: Essential Metrics for Micro-Project SuccessPortfolio Theory Applied to Charitable Giving

Modern portfolio theory offers powerful insights for charitable donors who want to maximize their social impact. Just as investors balance risk and return across financial assets, donors can apply similar principles to their giving strategy. The key lies in treating each charitable cause as an "asset" with its own risk-return profile and correlation to other causes.

Measuring social return requires different metrics than financial investments. Organizations track impact through measures like lives saved, education outcomes, or environmental benefits. Risk factors include program failure rates, organizational stability, and external factors that could limit effectiveness. Smart donors combine these metrics to calculate risk-adjusted social returns.

Read: Philanthropic Portfolio Theory: Maximize Impact Through Smart Cause DiversificationDiversification across multiple causes helps protect against program failures while maintaining steady impact. A balanced portfolio might include established health programs, emerging education initiatives, and experimental environmental solutions. This approach spreads risk while capturing opportunities across different social sectors.

Julie Goodridge recommends coupling stock donations with a donor-advised fund or direct contributions to non-profit organizations for a combined approach to charitable giving.

The optimal charitable portfolio balances proven programs with innovative solutions. Established interventions like vaccine distribution offer predictable results with lower risk. Meanwhile, new approaches like technology-based education programs present higher risk but potential for breakthrough impact. Smart donors maintain exposure to both types.

- Low-risk components: Established food banks, medical supplies, basic education

- Medium-risk components: Job training programs, mental health services

- High-risk components: Research grants, innovative poverty solutions, pilot programs

Regular portfolio rebalancing keeps charitable giving aligned with impact goals. Donors should review program effectiveness data and adjust allocations accordingly. This process helps maintain desired risk levels while responding to changing social needs and emerging opportunities.

Scaling Impact Sustainably

Effective charitable programs face a critical challenge when expanding their reach: maintaining quality while increasing quantity. Data from successful global health initiatives shows that organizations often hit a sweet spot of maximum impact before returns start declining. The key lies in identifying this optimal point and implementing structured growth strategies that preserve core program effectiveness.

Three proven models stand out for scaling charitable impact without sacrificing quality. First, the hub-and-spoke approach creates centralized expertise that supports satellite operations. Second, the franchise model standardizes core processes while allowing local adaptation. Third, the partnership network strategy leverages existing organizations to extend reach efficiently.

Prioritizing the engagement and development of existing donors is crucial for nonprofits to establish a dedicated and supportive community.

Organizations often stumble when rushing expansion without proper infrastructure. Common pitfalls include diluting staff expertise, losing program fidelity, and stretching resources too thin. These issues typically surface when growth exceeds 50% annually without corresponding increases in operational capacity. Smart scaling requires careful attention to maintaining donor relationships while building new ones.

Preserving impact during growth demands clear metrics and regular assessment. Successful organizations track both quantitative measures (number of beneficiaries, cost per intervention) and qualitative indicators (service quality, community satisfaction). They also maintain strong feedback loops between program staff and leadership to catch issues early.

- Set clear thresholds for minimum acceptable impact

- Build scalable systems before expanding

- Train new staff thoroughly in core methodologies

- Document and standardize successful processes

- Maintain strong quality control measures

The most effective scaling strategies focus on gradual, sustainable growth rather than rapid expansion. Organizations that double their impact every two years while maintaining quality outperform those attempting faster growth. This measured approach allows for proper integration of new staff, refinement of processes, and preservation of organizational culture.

Read: Data-Driven Crisis Response: Optimizing Emergency Giving for Maximum ImpactTax-Efficient Allocation Strategies

Smart tax planning transforms charitable giving into a win-win situation for donors and their chosen causes. The timing of donations plays a crucial role in maximizing deductions, especially for high-income earners who itemize. Strategic bunching of charitable contributions in specific tax years can push itemized deductions above the standard deduction threshold. This approach works particularly well with donor-advised funds, which allow immediate tax benefits while spreading out the actual charitable distributions over time.

The selection of assets for donation creates significant opportunities for tax efficiency. Donating appreciated securities directly to charities or donor-advised funds eliminates capital gains taxes while providing a fair market value deduction. Many donors overlook this powerful strategy, choosing instead to donate cash after selling appreciated assets. This common mistake triggers unnecessary capital gains taxes that could have supported charitable programs.

Julie Goodridge suggests that donating appreciated stock is a strategic approach to charitable giving, as it allows investors to potentially reduce their tax burden.

Donor-advised funds offer unique advantages for tax-efficient giving. These vehicles separate the timing of tax deductions from the actual charitable distributions. This flexibility helps donors maximize tax benefits in high-income years while maintaining steady support for charitable programs. The funds also simplify record-keeping and allow for anonymous giving when desired.

Read: Complex Asset Donation: Tax-Smart Guide for Private Business and IP GiftsDifferent giving vehicles impact allocation decisions in distinct ways. Private foundations require annual distribution minimums, which can force suboptimal timing of charitable support. Supporting organizations offer more flexibility but come with complex operating requirements. Each structure presents unique trade-offs between donor control, administrative burden, and tax efficiency.

The balance between tax benefits and program effectiveness requires careful consideration. While tax efficiency matters, it should not override the primary goal of supporting effective charitable work. Donors benefit from analyzing both the tax implications and the impact potential of various giving options. This dual focus ensures that tax strategies enhance rather than dictate charitable outcomes.

FAQ

How often should I reassess my charitable portfolio for diminishing returns?

Most charitable portfolios benefit from quarterly assessments to identify diminishing returns and optimize resource allocation. The frequency allows enough time to gather meaningful data while maintaining the flexibility to adjust funding strategies. Quarterly reviews help detect seasonal patterns and provide opportunities to rebalance giving across multiple programs.

Data shows that organizations who monitor returns more frequently than quarterly often react to statistical noise rather than true performance changes. Annual reviews, while common, can miss critical optimization windows and lead to inefficient resource allocation throughout the year.

What's the minimum funding threshold needed to accurately measure returns?

Accurate measurement of charitable impact typically requires a minimum annual giving threshold of $10,000 per organization. This baseline ensures enough statistical significance to differentiate between random variations and true performance patterns. Smaller amounts can still generate meaningful data when aggregated across multiple years or similar programs.

The Fundraising Effectiveness Project, an initiative by the Foundation for Philanthropy, reported a decrease in the overall number of donors in 2021, primarily attributed to a decline in small and micro-donations (under $500).

Organizations receiving smaller donations can pool resources with similar programs to achieve measurable outcomes. This collaborative approach enables smaller donors to participate in data-driven giving while maintaining statistical validity.

How do seasonal variations affect diminishing returns calculations?

Seasonal variations create natural fluctuations in charitable program effectiveness throughout the year. Winter months often show higher returns for housing and food security programs. Summer programs focusing on youth education demonstrate peak effectiveness during school breaks.

To account for seasonality, compare program performance to historical data from the same time period. This method provides more accurate diminishing returns calculations and prevents misallocation of resources based on temporary seasonal effects.

Can small donors effectively apply these mathematical models?

Small donors can successfully implement simplified versions of diminishing returns models. Basic spreadsheet tools and free online calculators provide adequate analysis for most small-scale giving portfolios. These tools help identify optimal donation timing and program selection without complex mathematical expertise.

Read: Monte Carlo Simulation: Transform Your Charitable Impact with Data-Driven GivingGroup giving circles and donor-advised funds offer additional options for small donors to access sophisticated analysis tools. These collaborative approaches pool resources and expertise, enabling donors of all sizes to optimize their charitable impact through data-driven decisions.

Additional Resources

The path to smarter charitable giving starts with reliable information and expert guidance. These carefully selected resources offer deep insights into measuring charitable impact and optimizing donation strategies. Each resource brings unique perspectives on maximizing philanthropic effectiveness through data-driven approaches.

Whether you seek practical frameworks or theoretical foundations, these materials provide valuable tools for thoughtful giving. The following resources range from academic research to practical guides, helping donors make informed decisions about their charitable portfolios.

- Giving What We Can - A comprehensive platform that analyzes charitable effectiveness through rigorous research methods. Their evaluations help donors identify high-impact giving opportunities across multiple cause areas.

- Money Well Spent: A Strategic Plan for Smart Philanthropy - This detailed guide explores methods for structuring impactful giving programs. The book presents frameworks for measuring outcomes and optimizing resource allocation.

- Give Smart: Philanthropy that Gets Results - A practical handbook filled with strategic insights for engaged philanthropy. The authors share proven methods for achieving measurable charitable impact.

Givewell.org, a charity rating site focused on alleviating extreme human suffering, conducts in-depth analyses of charities' impacts, including their ability to effectively use additional donations.

These resources complement each other by addressing different aspects of strategic philanthropy. They combine theoretical frameworks with practical applications, helping donors develop comprehensive giving strategies. The materials focus on evidence-based methods for evaluating charitable effectiveness and optimizing resource allocation.

Bonus: How Firefly Giving Can Help

Firefly Giving's platform brings data-driven precision to charitable resource allocation through advanced matching algorithms and zero-fee transactions. The platform's built-in charitable giving calculator helps donors find their optimal funding levels across multiple causes. This technology-forward approach lets donors maximize their impact by identifying high-potential opportunities before diminishing returns begin.

Matching gift opportunities can significantly incentivize giving, with 84% of donors more likely to donate when one is available.Read: AI Donation Timing: How Machine Learning Optimizes Charitable Giving Impact